May 2019

new edition of one of AWA’s key packaging and label market reports

LABELING AND PRODUCT DECORATION:

Global market update from AWA Alexander Watson Associates

According to AWA Alexander Watson Associates' latest researches, pressure-sensitive labeling continues to represent a 40% share of the global labeling technologies market, while the old-established glue applied technology claims second place, with a 35% market share, and the sleeve labeling technologies now represent a solid 19% share - and are still growing.

AWA's 2019 Labeling & Product Decoration Annual Review draws a detailed portrait of a market which, like all aspects of the packaging industry, is changing.

Current market status

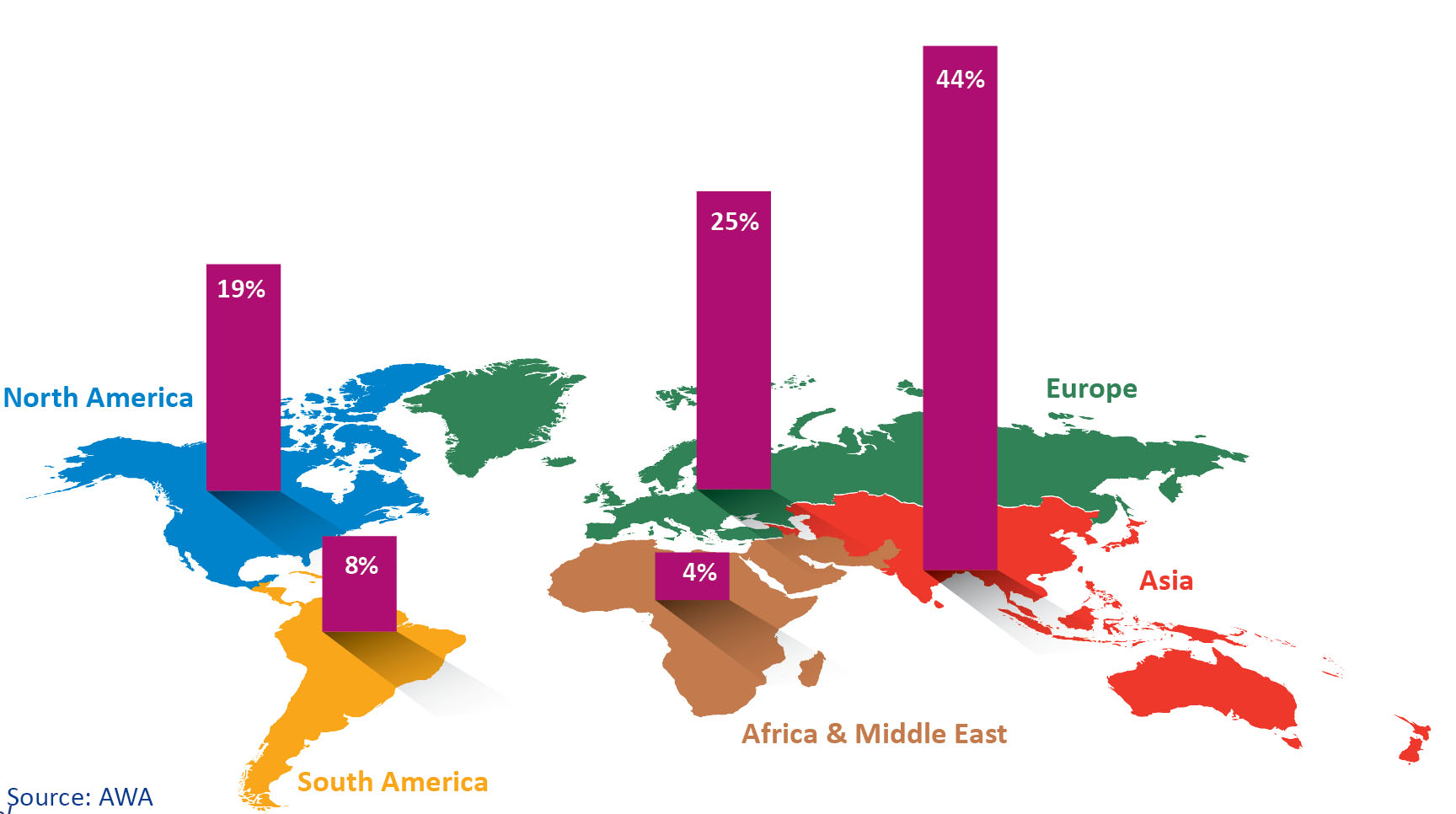

In 2018, AWA estimate that worldwide demand for all label types approximated to 64,245 million square meters - a healthy growth of 4.4% over 2017 volumes, in line with global GDP. The largest regional market continues to be Asia, with a 44% market share, and the leading growth drivers around the world are China, India, South East Asia, and the eastern European countries.

Major growth contributors

VIP labels are a major contributory force, reflecting the increased activity in e-commerce and transportation and logistics. This is particularly true for pressure-sensitive labels - which command the majority share of VIP labeling.

Sleeve labels - particularly heat-shrink sleeves -- continue to provide the main source of competition to pressure-sensitive and glue applied labels in the food and beverage market segments, and also to the in-mold labeling formats in household chemicals.

Major competitors

All the label formats are now competing with direct-to-package print, in terms of flexible packaging in particular, which is growing strongly in both the developed and emerging markets. An additional competitor is direct digital print to plastic, glass, and metal containers, which offers added brand-owner feature options in terms of limited editioning and personalization. The current focus on sustainability is also favoring renewed growth in printed cartonboard packaging. These alternative technologies are all benefiting from growth rates higher than those for traditional labeling.

Overall view

The changing market profile, along with raw material pricing, M&A activities in the industry, choice of labeling substrate, and perceptions of the market's future directions are at the heart of this thirteenth AWA Global Labeling & Product Decoration Market Update 2019. Featuring enhanced data on primary product labeling, end-user markets both globally and regionally, and label market growth trends, the report complements the company's in-depth studies that closely monitor the behavior of individual geographical markets, labeling technologies, and end-use markets for labels and product decoration. Full details are available via their website, www.awa-bv.com, where the report may also be ordered online.